What Bonds Are…And Why They Matter

With inflation’s recent acceleration, expectations are growing in the financial markets—and in everyday life—that interest rates may continue to rise, and could stay high for quite some time. The increased focus on interest rates, in turn, means bonds will become more top-of-mind. In this first installment of a two-part series on bonds, here’s what you need to know about what bonds are and how bond math works.

Are bonds different from stocks?

As different as night and day. It’s not terribly difficult to understand the stock market: When you buy a share of stock, you are buying an ownership stake in a company, no matter how tiny. The goal is to buy those shares at a good price, hold them while the company grows and their value rises, and realize a profit by selling them down the line. Many times, the companies whose shares you own will also pay you a dividend equal to a small percentage of your investment, and these dividends can be used to buy more shares, if you want. There’s no guarantee that you will see the full value of your original investment again.

Bonds work differently, although they aren’t risk free, as many people assume. Here’s how they work. In the real-life version of Monopoly, with bonds you stop being the player and become the

banker. When a governmental entity or a corporation wants to borrow money, say to fund its operations or expand its business, it sometimes turns to investors by issuing a bond. In exchange for you loaning the money they need now, they agree to pay you an agreed-upon level of interest for a set number of years, and then return the principal at maturity. You don’t get to own a part of the company—you are the banker making a loan. If you choose to hold this loan all the way until that pre-determined date (the bond’s “maturity”), you will get that original loan amount back, plus the interest payments along the way.

Bond Prices Over The Years

This chart from Macrotrends demonstrates how interest rates (in this case, 10-year Treasury rates) can rise and fall over the years.

What kinds of bonds are out there for investors?

- U.S. Treasury Bonds. With treasuries, the borrower is the U.S. government. These are considered as safe as it gets, and come in a few flavors: “T-bills” have maturities of up to one year, “notes” run from two years to ten years, and “bonds” are longer-dated issues.

- Municipal Bonds. Munis are issued by state and local governments (a.k.a. “municipalities”), and often are tax-free. This is often how roads, schools, libraries and other infrastructure projects are funded.

- Corporate Bonds. In these cases, the issuer is a company, as opposed to a governmental entity. Companies often have the option to issue stock, but may prefer to raise money through bonds instead. Ratings agencies grade the credit-worthiness of corporate bonds. (For more detail, see below.)

- Junk or High-Yield Bonds. This is a subset of bonds, sometimes called “junk” because their low credit ratings reflect higher risk. They may offer a potentially higher yield, but there’s an increased chance that the issuer will be unable to pay back the interest or the principal.

- Zero-Coupon Bonds. Most bonds issue a ‘coupon,’ an interest payment that you typically receive every 6 months. But sometimes the borrower will issue a zero coupon bond. Instead of paying you interest on a regular basis, they sell the bond at a lower price than you will eventually receive at maturity. The difference in price is the income you get over the life of the bond.

- Treasury Inflation Protected Securities (TIPS) and I Bonds. TIPS are a type of U.S. Treasury security whose value is indexed to inflation. The value of the bond rises when inflation rises, and the value will drop if there is deflation. I Bonds are government-issued savings bonds where the interest payments adjust based on inflation.

Bonds work differently. In the real-life version of Monopoly, you stop being a player and become the banker instead.

How does the repayment work, and how do price changes affect me?

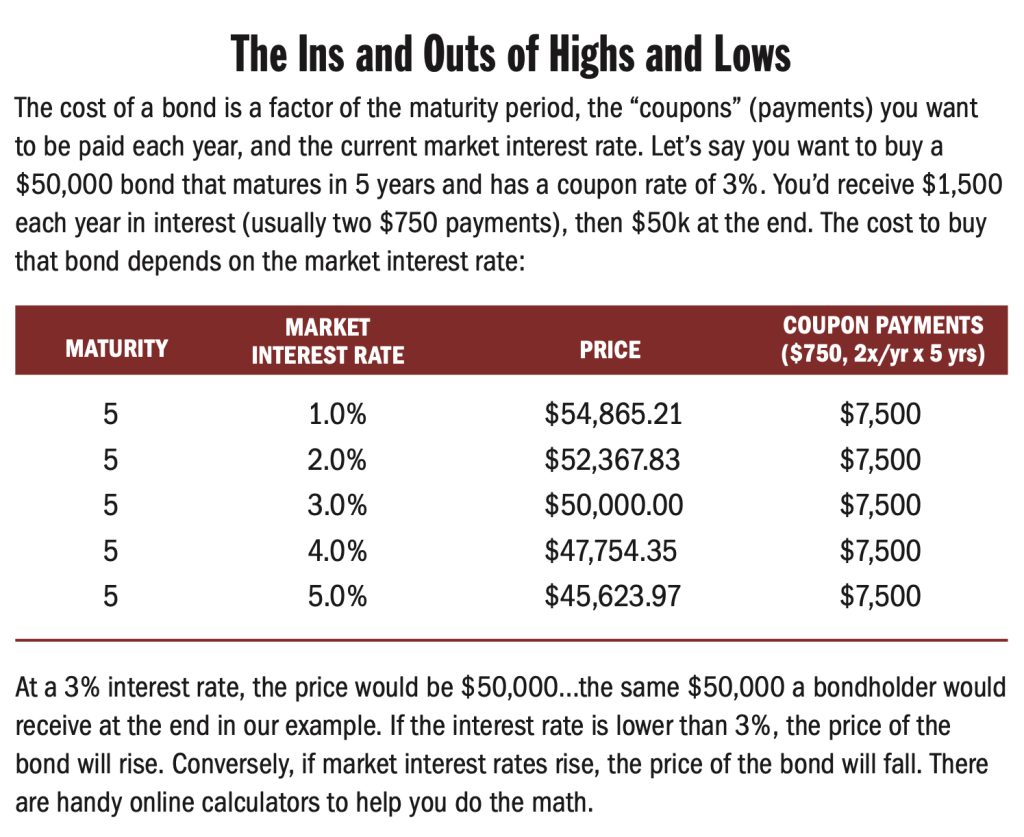

Let’s say a company wants to borrow money at a 3% interest rate, and you’re willing to lend them $50,000 for the agreed-upon period of 5 years. You give the borrower $50,000 now, and for the next 5 years, the borrower will pay you $1,500 a year in interest. At the end, you get your original $50,000 loan back.

That original loan was predicated on a 3% interest rate. You also have the option to sell your bonds in the secondary market, where the price can fluctuate with interest rates. As the original lender, if you hold the bonds until maturity you will be unaffected by these market price swings; you’ll simply get your $50,000 back at the end. But if you decide to sell it, the buyer will inherit your $1,500 a year interest payments (but not your 3% yield). If interest rates have risen to 4% since you bought the bond, for example, an investor wouldn’t offer you the same $50,000 price you started with for that 3% coupon: Why would they buy a 3% interest stream from you when they could buy a 4% interest stream from someone else for the same investment? To sell the bond in your possession, you would have to discount the price to $47,754, so that the $1,500 a year that

the buyer gets no longer reflects 3%, but, in this example, a 4% yield on their investment.

What causes interest rates to rise and fall?

Market interest rates do go up and down. At a very high level, the ups and downs of interest rates are determined by the amount of money in the system.

Interest rates reflect the “cost of borrowing” money. If there is excess money in the system, the cost of borrowing will go down and interest rates will fall. Economists will refer to this situation as “easy” money. Conversely, if there is a lack of money in the system, the cost of borrowing (and, therefore, interest rates) will rise. When this happens, economists use the term “tight” money.

The Federal Reserve is America’s central bank, and its role is to use short-term interest rates to speed up and slow down the economy. The Fed sets short-term federal funds rates, and can impact long-term rates through bond programs referred to as quantitative easing or tightening. Things like mortgage rates and long-term bond rates often follow along, but are controlled by market pressures, so what happens isn’t always straightforward. As a measurement of the acceleration (or deceleration) in prices for goods and services, inflation (or deflation) is always present. The key is the speed at which these prices are moving one way or another—prices tend to move up, but sometimes they move up faster than at other times. If inflation is rising too fast, that could mean the economy is overheating, and consumers will eventually balk at spending. If they stop spending, that, in turn, could possibly throw the economy into recession, where people can start losing their jobs.

Of course, the Federal Reserve doesn’t want this scenario to occur. When it sees inflation threatening the health of the economy, as it did in early 2022, it will decrease the supply of money in the economy. In turn, with money scarcer, banks will charge more to borrow, by raising interest rates on new loans in the market. The effect is to dampen the demand for credit that might be used to fuel economic growth. With growth more expensive, the economy—and inflation—should naturally slow down to a more comfortable level. If, on the other hand, the Federal Reserve thinks the economy is struggling, as it did at the beginning of the coronavirus crisis, it will lower interest rates, making it cheaper for companies to borrow money so they can invest in new equipment or expanding a product line, thereby stimulating the economy and keeping people employed.

Treasury bills and FDIC-insured Certificates of Deposits are considered the safest investments and, as a group, will get the highest credit ratings.

Are bonds absolutely safe? Do I have any protection against default?

One of the risks bond investors face is the ability of the bond issuer to be able to make the scheduled interest payments, as well as the principal payment when the bond comes due. Different issuers have different degrees of safety and risk. Let’s tackle these in descending order of safety.

Treasury bills and FDIC-insured Certificates of Deposits are considered the safest investments and, as a group, receive the highest credit ratings. Investment-grade corporate bonds and municipal bonds would be considered somewhat less safe (and issuers pay a higher interest rate because of this), with so-called junk or high-yield bonds at the riskiest end of a scale of safety. Some municipal borrowers buy insurance to make sure their lenders will be repaid. This is ostensibly to lower the risk inherent in their bonds, which raises their credit rating and thus lowers the interest rate they will have to pay.

Who decides what level of risk each individual bond holds? Independent bond rating companies formally gauge the risk of each bond issue before they are sold to the public, and then again throughout the life of the bond. Standard & Poor’s, Moody’s, and Fitch are three of them. These ratings companies

use different systems and different rating codes, but the idea is the same. Generally, bonds are rated the way you used to be graded on a test in school. If you got 100% you received an A+, and in the bond world this would correspond to a Triple A rating (AAA) from a rating agency. If you scored a 90%, you’d get an A-, and it’s the same with the bond rating agency: still a very good grade, just not a perfect score.

Bond ratings go from AAA all the way down to D. One of the key levels is BBB, or triple-B. Anything rated BBB- (triple B minus) or higher, including the A category grades, is considered “investment grade.” If you receive a score of BB (double B) or less, like a C or a D, it is considered a junk bond. This does NOT mean they cannot pay, or that you won’t get your money back. It simply means that the rating agency feels this bond issuer’s ability to pay you back is more in question than that of a higher-rated company.

How do I know whether the bond market is right for me?

There are a number of ways in which bonds can be a valuable addition to a balanced portfolio. At McRae Capital Management, we are happy to advise on the specifics. In Part 2 of this series, we’ll take a deeper look at our philosophy regarding why, when, and how investors use bonds to reduce risk in their investment portfolio.

McRae Capital can help you understand a host of topics, like the risks of market volatility, how to live off retirement savings, and why taking the long view as an investor is so very important.

How Bond Coupons Work

Connect your finances to what matters most

This article can provide only a general understanding of sometimes difficult financial concepts. For for a more thorough explanation, or if you have questions about your own portfolio, please feel free to reach out to us here at McRae at (973) 387-1080.