How Bonds Work and When They Make Sense

In the previous installation of our two-part series on bonds, we discussed how bonds are different from stocks: With stocks, you’re an owner of the company, with an equity stake. But with bonds, you become a banker, lending your money to a government or corporation. Used correctly, bonds can play a significant role in reducing the risk of an equity-dominant portfolio. In Part 2 of this series, let’s examine this balancing act, and how we at McRae Capital Management can help you deploy fixed-income investments to achieve an optimal risk-adjusted portfolio return. Here are a few of the questions we commonly hear about putting bonds to work.

I hear that bonds are safer than stocks. Is it true?

The first thought that often comes to an investor’s mind when thinking about bonds is their safety, especially when compared to stocks. The riskiness of stocks is probably easier to visualize: if you buy a stock for $25 and it drops to $3, you’ve lost a substantial amount (at least on paper). A bond is a longer term commitment, and might feel inherently more stable: You, the bond holder, lend money and receive interest payments over a set period that’s called the maturity. When the bond matures, the lender returns your initial investment, and the loan agreement ends. You can now use that money to buy another bond, invest in another asset or spend it.

But all investments carry risk, including bonds. The success of your bond contract is dependent on your borrower being able to make their interest payments AND to be able to return your initial investment upon maturity. We have all heard stories about lending money and not being paid back, and the basic principle holds in the investment world. Considering all bonds “safe” is unwise. Like any investment, bonds need to be analyzed and risks understood.

Bonds do, however, often have safety features built in. Government bonds, for example, are backed by the full faith and credit of the U.S. government. Certificate of Deposits, issued by banks, are backed by FDIC insurance to protect you if the bank defaults. Municipal Bonds can be backed by the credit of the state or municipality. With bonds issued by corporations, typically bonds are senior to stock—meaning that if a public company were to run into financial difficulties, including bankruptcy, bondholders are ahead of shareholders in the line to be repaid.

But even though bonds do come with risks of their own, as part of a balanced portfolio they can help mitigate the inherently greater risk that comes with owning stocks. After all, with bonds, you are a lender, not an owner, and quality bonds can provide income to your portfolio and help you protect your principal.

Where exactly does the danger lie with bonds?

At McRae, we’re happy to work with you to choose the right bonds…for the right reasons. Bonds have particular risks, and, apart from federal government issues, may not be as safe as they first seem. Here are a few specific risks:

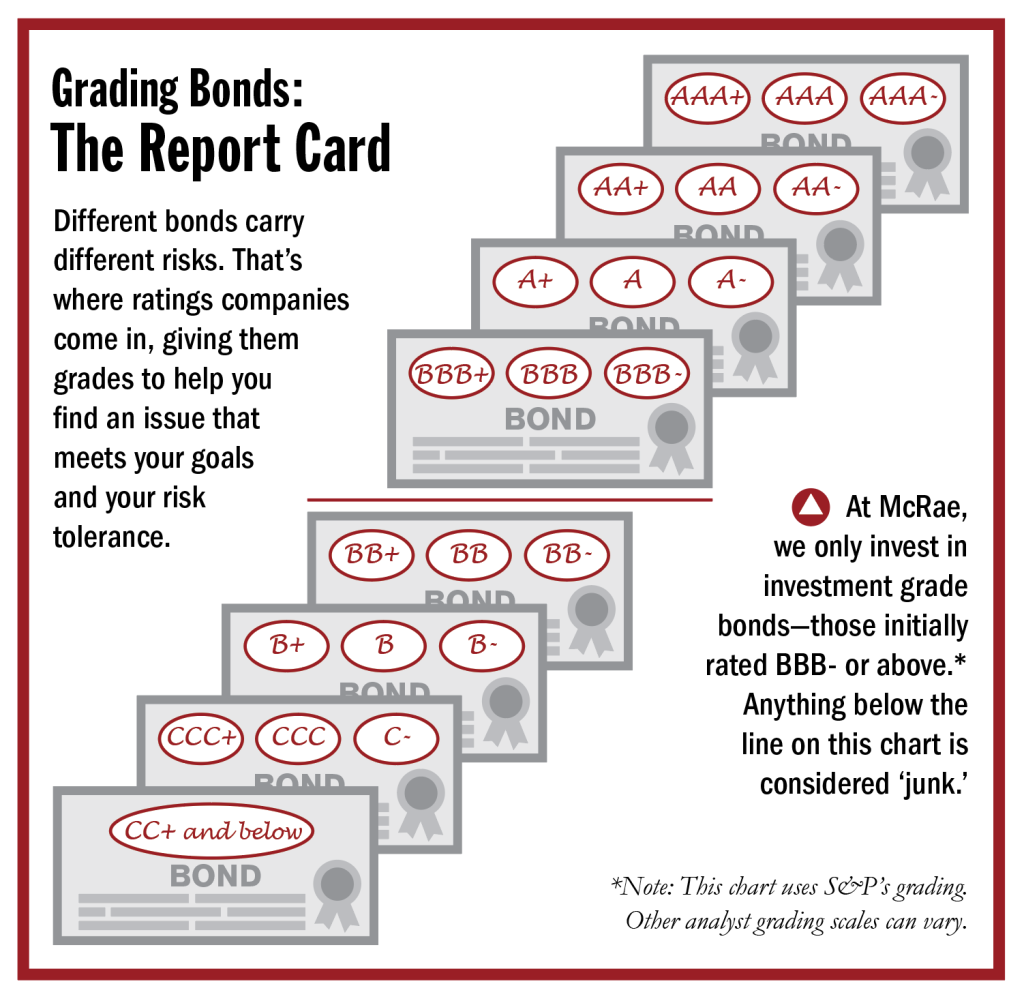

- Quality, or credit, risk. This risk type is driven by the creditworthiness of the borrower. The U.S. government is a colossal borrower of money, but considered extremely safe— after all, it could theoretically print money to pay you back. In a normal interest-rate environment, the Federal government pays a lower interest rate than any borrower. With corporate bonds, the risk of bankruptcy—and default—is higher, so companies pay higher interest rates across different tiers according to their credit ratings. Municipal entities at the state and local level may pay lower rates based on the tax benefits they receive. It is important to compare after-tax returns on any bond to see which may benefit you the most.

- Interest rate (or market) risk. There are other risks beyond general creditworthiness of the borrower. For one thing, interest rates vary over time, and that means the resale value of your bond holdings will move right along with them. For example, when the Federal Reserve sees inflation threatening the health of the economy, as it does now, it can reduce the money supply. This, in turn, leads to higher interest rates on new loans, making those loans less enticing; their price will fall.

- Maturity risk. Remember that bonds pay a stated rate of interest over the life of the bond, then return your principal on a set maturity date. The maturity date could be rather quick, say 3 or 6 months, or it could be much longer, like 20 or 30 years. If you buy a bond with a 30-year maturity, you are expecting a specific income stream for the entire time. But if rates should rise over that 30-year time frame, your bond will still pay interest to you at the lower rate you agreed when you purchased the bond. This could represent significant lost opportunity, if those rates stay high for a long time.

- Reinvestment risk. Some corporate bonds, when they are first issued, are designed to be callable. A callable bond lets the borrower back out of their original promise, and decide after a shorter period of time to return your money to you. Sure, you’ll get your principal back sooner, and what could be wrong with that? Well, if the borrower is cutting a loan short, it’s probably because they feel they can take another loan out at a lower interest rate. If you take your principal repayment and invest that into a new bond, it will most likely be at a lower rate as well.

Interest rates vary over time, and that means the resale value of your bond holdings will move right along with them.

How would McRae incorporate bonds into a portfolio like mine?

The benefits bonds bring to a portfolio include providing income, reducing volatility, and protecting principal. At the same time, we have highlighted there are risks to owning bonds. Your goal should be to intelligently balance the benefits and the risks.

To address quality risk we focus on the safety of your investment, focusing more heavily on U.S. Treasuries, U.S. government-agency securities, municipal bonds, and high-grade corporate issues. We do not invest in bonds that are rated below investment grade, commonly called “junk” bonds. (See sidebar, “Grading Bonds: The Report Card.”) To address interest rate and reinvestment risk we focus on issues with shorter maturities inside 10 years (and often inside 5 years).

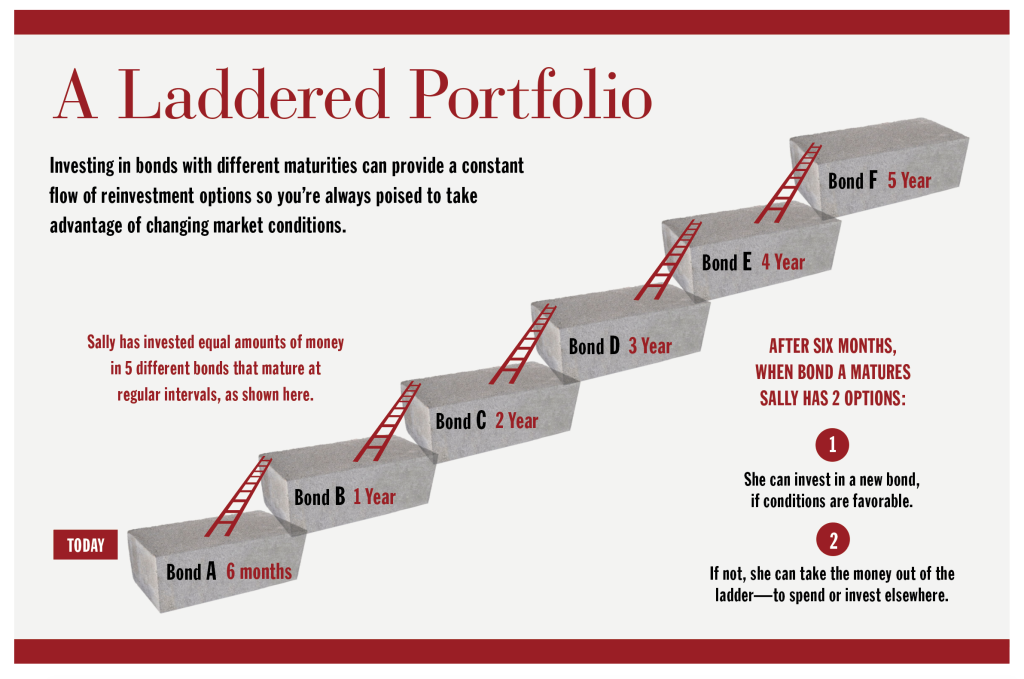

For many clients, we combine these strategies by building a bond “ladder.” (See sidebar, “A Laddered Portfolio.”) Breaking a bond investment into smaller pieces and buying a group of bonds with increasing maturities creates a bond portfolio with a series of maturity dates—say, 6 months, then a year, then 18 months—that can be thought of as rungs on a ladder. When the first bonds mature and your investment is returned to you, you can reinvest it into bonds of a differing maturity—longer or shorter depending on the rate environment. This way, you’ll have diversified your portfolio over a series of maturities and can respond to market conditions over the years.

Laddering can also be an effective liquidity strategy. Blending the length of your individual holdings allows you to make sure principal is always available when you need it. Every few months, as bonds mature, it adds cash to your portfolio that can be used for cash needs or to roll over into new investments.

I’ve heard that bonds have benefits for older people, but that younger investors should stick with stocks. Is that correct?

Well, it’s true that the younger you are, the more your portfolio will likely be tilted toward stocks—you have more years ahead of you to recover from any market downturns. But sometimes, if you know well ahead of time that you have a big expense coming up (a college tuition payment, for example), bonds may make sense no matter your age. When the money you’ve saved absolutely needs to be there at some future date, but you’d still like to take the opportunity to invest it and earn a positive return in the meantime, an investment adviser like McRae can help you find the right short-term issue to meet that need.

As you can see, there are many reasons for investing in bonds, depending on each investor’s individual age, circumstances and goals. At McRae Capital Management, we can help tailor your individual bond portfolio to your specific needs, factoring in credit quality, yields, after-tax returns, and maturities in anticipation of changes in interest rates. We can help you understand your cashflow needs and your risk tolerance, and translate that into portfolio changes that bring smart, well-priced fixed-income investments into an anchor position among your investments. Give us a call to see how we can help you today.

Evaluating Bond Risk Wisely

Bond Repayment and Reinvestment: A Long-Term Strategy

Connect your finances to what matters most

This article can provide only a general understanding of sometimes difficult financial concepts. For for a more thorough explanation, or if you have questions about your own portfolio, please feel free to reach out to us here at McRae at (973) 387-1080.