Financial Planning Around Divorce or Death in the Family

Assessing your long term goals, planning accordingly, and revisiting details of your plan as each life stage comes up for you is a great general strategy for making financial planning a rewarding way of life. But not everything happens as planned, and sometimes, unfortunately, life throws us a curveball. In reality, financial planning around divorce or a loss in the family isn’t usually part of the program.

Unexpected events can wreak havoc on the best-laid plans. By definition, they’re things you haven’t planned for, and they instantly expose any gaps in your overall financial planning. Worse, they often involve a powerful emotional component and a need for short-term decision making—imagine the loss of a spouse, for example—and that’s a high-octane combination that all too often leads

people to make rash decisions that can have dire long term consequences.

Even for these unplannable events, there’s help. One of the most important things to remember when confronted with such a situation is to take a deep breath, and give yourself time to think. The moment of maximum chaos is the worst time to make important financial decisions, so don’t do anything until you’ve had a chance to process the situation and think things through clearly—including speaking with experts you trust.

Here are two specific cases worth thinking about.

Unfortunate Event: The Loss of a Loved One

Losing a family member is devastating. Whether a long illness has given you an opportunity to prepare or the passing was tragic and unexpected, when we lose someone close to us, we’re really never prepared emotionally. It’s imperative to allow yourself time to grieve. That said, there are financial decisions that will need to be made relatively soon, and thinking about them now can help ease that extra burden.

You or a family member may for example be the executor or executrix of the will. This can be a stressful responsibility when dealing with money and other family members, and you’ll need to have a team including an attorney, an accountant and a financial advisor like McRae Capital Management to help you through the process.

A few specifics to think about:

- Several copies of the death certificate will be needed. Get at least 15.

- First step: The will of the deceased will probably need to go through the probate process. In probate court, the judge will accept the will and name you as executor/executrix, and you’ll receive either a surrogate certificate or Letters Testamentary that, together with the death certificate, will allow you to act on behalf of your deceased family member.

- Assets will have to be identified, collected and distributed, a process that can take several months.

- You’ll have to present the death certificate and surrogate certificate to firms holding certain of the deceased’s assets, like stocks, bonds, and cash, authorizing them to transfer the assets into a new “estate account” you’ll set up so you can distribute those assets as dictated by the will.

- Some other assets, like Trusts or IRA accounts, will come with their own transfer instructions; others, like an owned business or real estate, will need to be valued and then either sold or transferred to family members.

- It is important for family members who “expect” an inheritance to understand it always takes time to secure the assets—don’t let anyone pressure you!

- Several months after your loved one’s passing, you may need to file an estate tax return and pay any necessary estate taxes.

When we lose someone close to us, we’re never prepared emotionally. That can be a tough time to have to make important decisions.

Unfortunate Event: Divorce

Divorce is one of the most upsetting, stressful, and generally unsettling events we help our clients face. Whether it’s your own relationship or a member of your close family, divorce also divides a financial partnership, and so it creates unique financial issues to consider. Some examples:

- Divorce always takes longer than people expect. During this time, expenses can increase significantly.

- Part of the divorce process is dividing up financial assets. It’s imperative to remember that all assets are NOT the same: Cash is easy to divide, for example, but dissolving stocks and bonds may incur unwelcome tax implications, and retirement accounts, such as 401k or IRA accounts, have their own complications. Some assets, like a home, may be harder to value or sell. It is important to evaluate divisible assets not only on their worth, but on their ease of sale and the tax implications of doing so.

- You or your spouse may be dependent on alimony and child support. But divorce decrees aren’t always final in this regard; some revisit these issues (and payments) should your ex-spouse lose a job, become ill, or pass away.

- After the divorce, you will once again be financially separate individuals—an important time to revisit your personal financial planning, and take a look at your credit rating, debt, and investments, adjusting as necessary to make sure you’ll be able to do all the things you want to do in the future.

Nobody wants disaster to strike. But when it does, it helps tremendously to have a working financial plan already in place. When you’re ready to get YOUR plan together, reach out to us at McRae Capital Management: We’ll bring 35 years of experience to bear helping you prepare for the best…AND the worst.

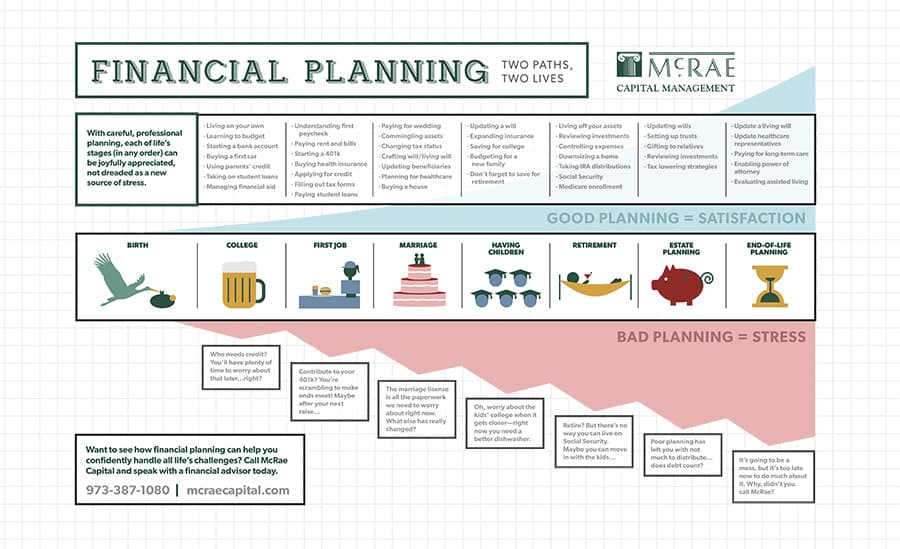

Financial Planning Infographic

McRae Capital can help you understand a host of topics, like the risks of market volatility, how to live off retirement savings, and why taking the long view as an investor is so very important.

Connect your finances to what matters most

This article can provide only a general understanding of sometimes difficult financial concepts. For for a more thorough explanation, or if you have questions about your own portfolio, please feel free to reach out to us here at McRae at (973) 387-1080.