General Budgeting

General budgeting is the most important aspect of any financial plan—even the best-laid investment strategy will fail if you’re spending the returns as you go. Creating a sound budget you can adhere to, that curbs excessive spending and gives returns a chance to grow, is paramount to long-term financial success.

McRae Capital Management can help you create and maintain that budget, whether you’re an individual, a family, or a corporate entity. The process starts with an honest look at your long-term goals and your current needs, as well as understanding that tradeoffs need to be considered in the service of building wealth over time.

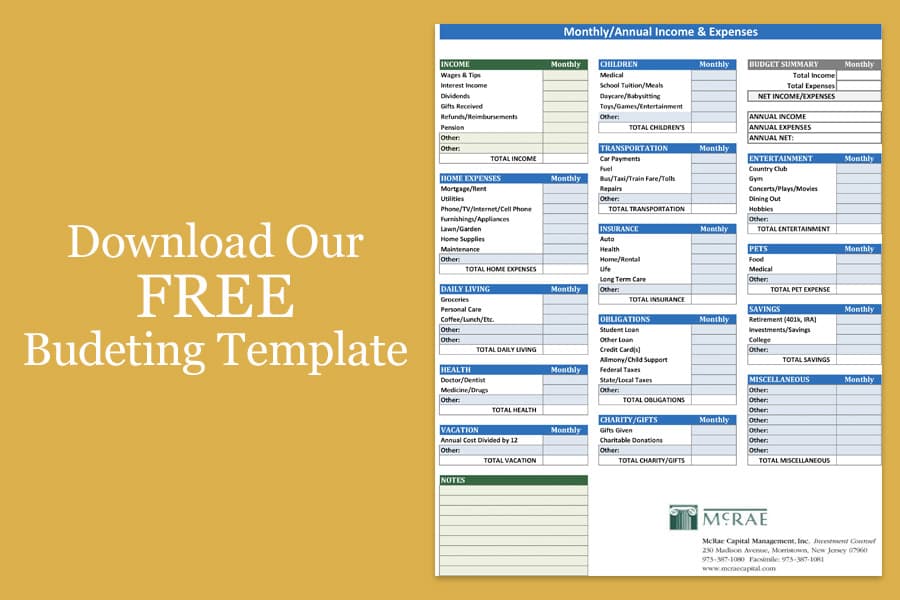

To get our clients started, we created a handy Budget Template to identify the basic items in your general budgeting and sort them by whether they’re required (like food, heat, gas for your car) vs discretionary (like travel, gifts, and luxury items). Being able to identify what your “core” needs truly are is a critical first step. That daily Starbucks iced caramel macchiato may FEEL like a requirement, but…

McRae Capital can help identify factors you may not have thought about. Things like relevant tax issues that may affect your budget, including IRA distributions, alimony, and social security, all of which have tax implications and need to be accounted for. Similarly, geography can play an unexpected role, as individual states have different tax rates and different tax treatment of assets, which can have a bigger impact than you might think on your current and future costs.

We can also suggest modifications, now or at a set time later, that can help you budget effectively. Healthcare, for example, is a constantly changing item, and charting a change from an employer plan to Medicare and associated Medigap plans can be considered at the appropriate time. And as retirement nears, it’s worth considering downsizing a home to free up cash to support retirement. Gifting assets to family members and making charitable donations are two common ways to help manage estate tax issues, and we can guide you through the details of those decisions as well.

If you are interested in making sure YOUR general budgeting strategy is set up to promote maximal gain from your investments, McRae Capital can help—give us a call to set up a free consultation. If you’re specifically interested in sharing valuable information about financial planning for a young person starting their first job, we invite you to read our First Job Commentary, or watch/share our video.

If a young person in your life is having a first child and wondering how to navigate the finances, please read our Having Children Commentary, or watch/share our video.